do you have to pay taxes when you sell a car in california

Otherwise the Buyer pays the Tax to the DMV when they change ownership and Register it. The buyer is responsible for paying the sales tax.

California Vehicle Sales Tax Fees Calculator

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

. The sales tax is. However this includes rental. Their signature is required on Line 1 of the.

So if you live in a state with a. To take over ownership of a vehicle you will need. You do not need to pay sales tax when you are selling the vehicle.

There are some circumstances where you must pay taxes on a car sale. You can use the DMVs fee calculator to estimate any. A taxable gain occurs when something sells for more than its cost basis.

According to Carbrain you may or may not have to pay taxes when you give or receive a car as a gift. Only if the seller has a Sellers Permit. When youre purchasing a new or used car its important to understand the taxes and fees you may face.

The Bureau of Automotive Repair. You dont have to pay any taxes when you sell a private car. The short answer is maybe.

You likely paid a considerable amount of. Thankfully the solution to this dilemma is pretty simple. In California the sales tax is 825 percent.

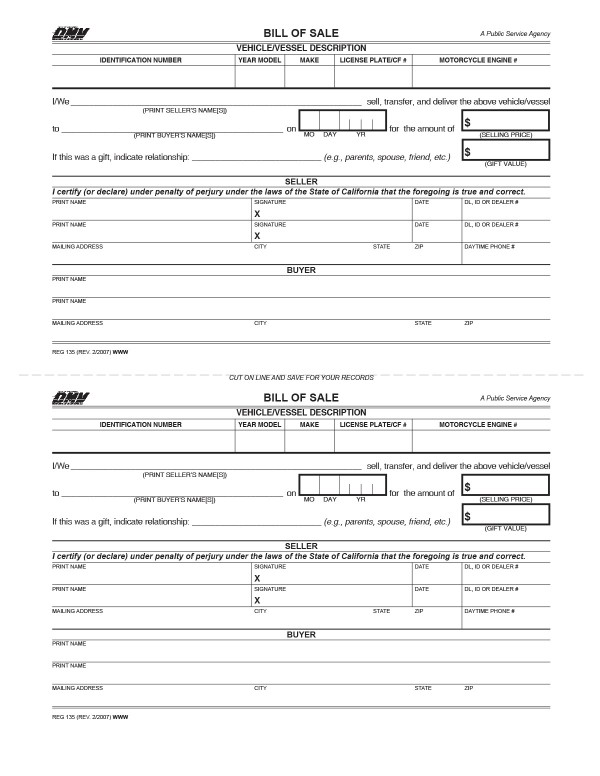

The vehicles title sometimes referred to as a pink slip signed by the person selling the car. California statewide sales tax on new used vehicles is 725. Answer 1 of 5.

While some car owners consider selling the car for a dollar instead of. A 15 transfer fee and a 8 smog transfer fee for a combined total of 23. When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle.

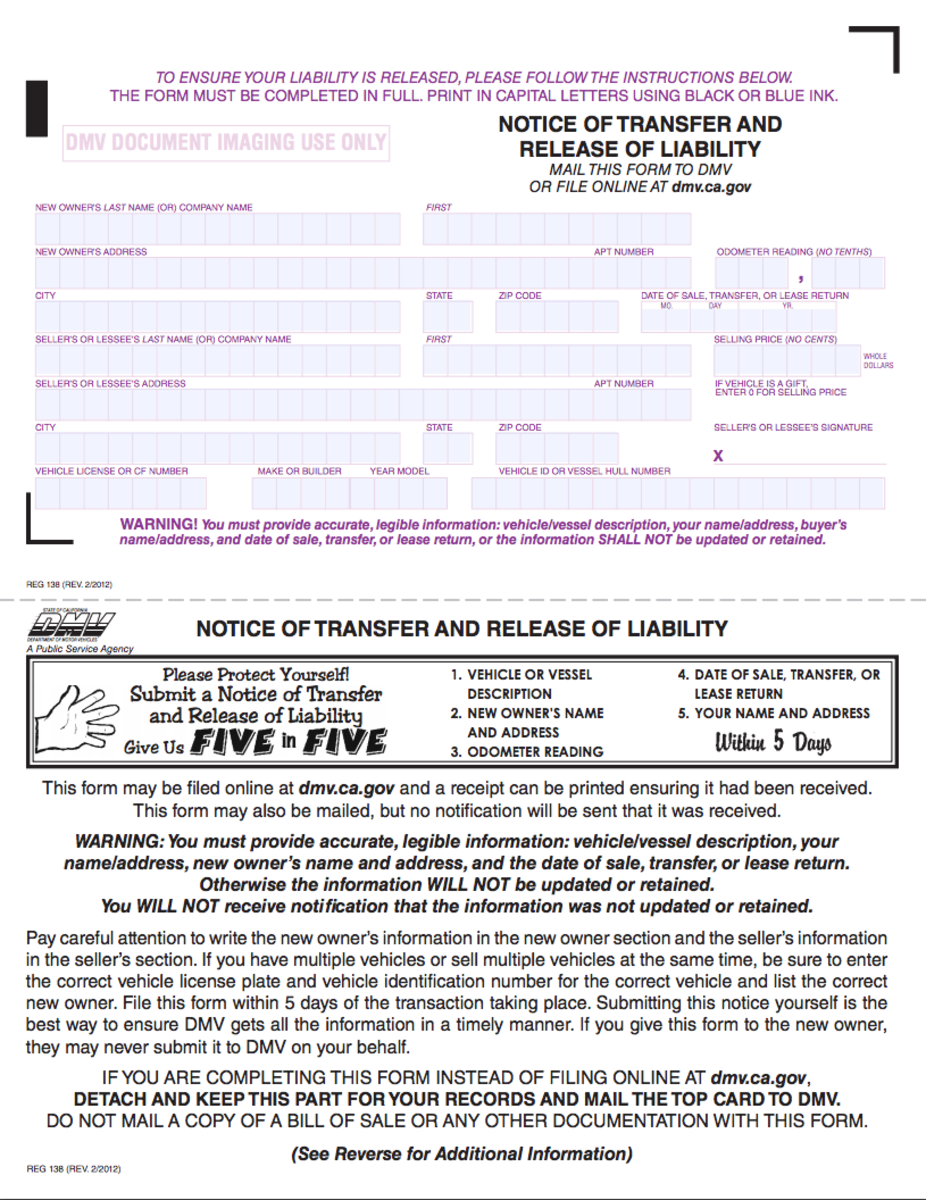

In California a title transfer requires two fees. The state only taxes income earned in California. For more information on out-of-state vehicle purchases issues look to.

Its very unusual for a used car sale to be a taxable event. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and. Although a car is considered a capital asset when you originally purchase it both state.

4 hours ago For example if the car sales tax in your state is 10 and you gift a 30000 car you can save 3000 on sales tax. The Department of Motor Vehicles Technical Compliance Section at 916 657-6795. Do you have to pay taxes on a gifted car in California.

Answer 1 of 4. If you earn income in any way in California after moving you will likely still pay taxes on it to California.

Understanding California S Sales Tax

Do You Pay Sales Tax On A Lease Buyout Bankrate

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

How To Register File Taxes Online In California

Buying A Car Without A Title What You Should Know Experian

Vehicle Transactions Not Subjected To Use Tax In California Inheritance Gifts Domestic Partner Title Transfers More Etags Vehicle Registration Title Services Driven By Technology

Can You Sell A Vehicle You Just Bought

States With The Highest Lowest Tax Rates

How To Register Your Out Of State Vehicle In California

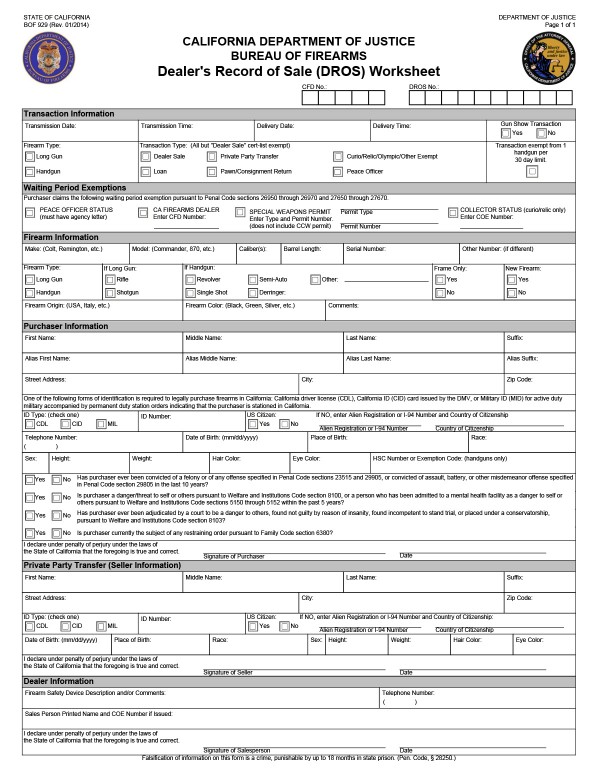

How To Get A Car Dealers License In California 12 Steps Dealer 101

California Vehicle Tax Everything You Need To Know

Here S Why So Many Exotic Cars Have Montana License Plates Autotrader

How To Buy A Used Car From A Private Seller In California Axleaddict

All About Bills Of Sale In California The Facts And Forms You Need

What S The Car Sales Tax In Each State Find The Best Car Price

Can I Get A Tax Deduction If I Give A Car Away

Should I Buy An Out Of State Car Edmunds

All About Bills Of Sale In California The Facts And Forms You Need

How To Register Vehicles Purchased In Private Sales California Dmv